Investing As A Pastor's Kid - 7 Biblical Principles For Christian Investing

Throughout the bible, Investing and creating wealth are mentioned literally hundreds of times. You’ll find incredible wisdom about how to grow your money wisely while keeping your relationship with God in good standing. You’ll also find wisdom on how to avoid unwise investment tactics that aren’t sustainable and will ruin you spiritually.

Does the Bible even mention wealth - positively?

Of course, what we tend to hear is all the negatives. Growing up as a PK we didn't do super well financially. It was almost like a conceived idea in our circles that wealthy people loved their money more. So it was like frowned upon to seek financially wisdom and wealth literacy. We heard all the stories about the rich men stumbling, and how money was the source of all evil and you fast-forward 20 years and I realized that's not the case.

Wealth is exceedingly dangerous. Investing is extremely risky. Is there a possible way that investing and Christianity can co-exist? Yes absolutely!

Wealth has a history of spiritually devastating those who seek it, and must be handled with great care by the Christian investor. People who want to get rich fall into temptation and a trap and into many foolish and harmful desires that plunge men into ruin and destruction.

For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs. (1 Tim. 6:9-10)

Command those who are rich in this present world not to be arrogant nor to put their hope in wealth, which is so uncertain, but to put their hope in God, who richly provides us with everything for our enjoyment. (1 Tim. 6:17)

Christian Investing vs investing?

How does “Christian investing” differ from investing generally? Is it a matter of avoiding all risk? Of refusing to invest in certain companies? Of seeking out only “Christian” investments? A Christian approach to investing begins with an attitude — an attitude of seeking God’s glory and driving His kingdom forward.

The earth is the LORD’s, and everything in it, the world, and all who live in it; for he founded it upon the seas and established it upon the waters. (Ps. 24:1- 2,)

God’s ownership of all things includes: “your” money, “your” cars, “your” house, and, yes, “your” investments! When you make investments as a Christian, you recognize that you are not investing what belongs to you; you are investing what belongs to the Lord.

🌱 Be faithful to your seeds

God created the principle of seed and sowing. You reap what you sow. Actions have consequences, you get the idea. If your desire is to build massive wealth, then you first need to be trustworthy and disciplined with what you already have. You will never become wealthy if you’re living paycheck to paycheck and spending more than you make. You must be the master of your money before the Master will trust you with more. Master your money - not be mastered by it.

In Mark 4:3-9 the parable of the sower talks about the importance of sowing seed into good ground.

3 “Listen! A farmer went out to sow his seed. 4 As he was scattering the seed, some fell along the path, and the birds came and ate it up. 5 Some fell on rocky places, where it did not have much soil. It sprang up quickly, because the soil was shallow. 6 But when the sun came up, the plants were scorched, and they withered because they had no root. 7 Other seed fell among thorns, which grew up and choked the plants, so that they did not bear grain. 8 Still other seed fell on good soil. It came up, grew and produced a crop, some multiplying thirty, some sixty, some a hundred times.”

There are several awesome biblical investing principles here worth looking at.

Seeds must be sown

2 Corinthians 9:6-8- “Remember this: Whoever sows sparingly will also reap sparingly, and whoever sows generously will also reap generously.”

Just like real seeds, money can’t grow and produce more if you don’t put it to work. Stowing your money in a savings account or under the mattress doesn’t build wealth effectively. It's actually losing its value because of inflation.

Don’t consume all your seeds

Unfortunately, too many of us live on more than we make. And when you spend more than you make, you have no seed to sow and multiply for a future harvest.

Then, when hard times come and life happens, you have no reserve to draw from, and you’re forced to make desperate financial decisions. Managing your finances so you can consistently sow financial seed. It's basic responsible preparation then laying a proper foundation reflects responsible planning.

In the house of the wise are stores of choice food and oil, but a foolish man devours all he has. (Prov. 21:20)

The plans of the diligent lead to profit as surely as haste leads to poverty. (Prov. 21:5

❌ Eliminate bad debts

Pay all your debts, except the debt of love for others. – Romans 13:6

One thing very clear about that the Bible is that God’s word is very much against debt. God highly encourages the quick elimination of debt. And why be adamant about it even if we are talking about investment here? That is because by eliminating bad forms of debt, you free yourself from interest payments. This excess can now be appropriated for investing.

Avoid investing when you carry huge consumer debt. A credit card balance carries a 36% annual interest. In contrast, equity fund returns for the past 10 years average 17%. You stand to gain more by eliminating bad debt first.

You may have noticed I repeated "bad debt" several times. That's because I don't buy into the Dave Asprey's mindset that all debt is bad debt. I also don't believe in Grant Cardone's theory that all debt is good you can say.

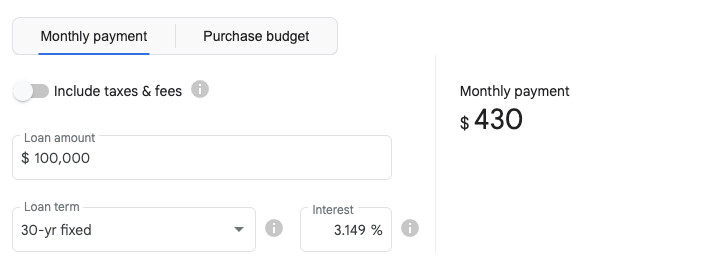

If you have money saved to carry you for several months, then building debt that is paying for itself and then some could become a wise investment. Something like rental properties. Where the monthly rent amount is much less than the mortgage amount. For easy math:

You can buy a $100,000 property for 3.5% down, or $3,500. That would be a $430 loan. You could turn around and simply following the 1% rule (rent should equal 1% of property value) you should be able to rent it out for $1,000 a month. After taxes you should be netting at least $300 per month plus appreciation. Your initial investment of $3,500 would be paid for in month 11. In three years that's $10,800 (300*36), or a 35% return on investment (again + property appreciation). In the stock market you would have about a $840 (8%*3) in the same three years if you invested in an index ETF.

🧮 Diversify your investments

Cast your bread upon the waters, for after many days you will find it again. Give portions to seven, yes to eight, for you do not know what disaster may come upon the land. – Ecclesiastes 11:1-2

Diversification is a strategy in investing. If done right, it can spell the difference between profit and loss. Nowhere does it guarantee success but at the very least, it diminishes the risk we are undertaking. No matter how profitable one investment may seem, it is never wise to put everything you have in that basket. Hence, the timeless investment advice, “Don’t put all your eggs in one basket.”

Due to the uncertainties in the financial markets, we should properly diversify our portfolio with a mixture of investments; and also constantly rebalance our assets to maximize our returns and minimize losses.

My overall portfolio includes a few things:

- Stocks - mainly ETFs

- Crypto - mainly ETH

- Cash - mainly because the market is so high

- Bonds - mainly because the market is so high

- Real Estate

- Equity Crowdfunding

- Peer to peer lending

🧠 Invest only in things you understand

By wisdom a house is built, and through understanding it is established; through knowledge its rooms are filled with rare and beautiful treasures. – Proverbs 24:3-4

As a general rule in investing: invest only in things you understand. If you don’t understand what you’re getting into, don’t! Anytime you invest, you should fully understand what you’re investing in. If you can’t explain it to someone else so they can completely understand it too, you don’t need to invest.

Everything involves risk, even cash. But there is a long list of due diligence that can be done to minimize the risk. This is part of being a good steward.

It’s extremely easy to be drawn into complicated investments that sound great on the surface but are rife with risks that cause you to lose most or all of your money.

You need to know the level of risk you’re taking on as well. Every investment, including keeping your cash in a savings account, involves risk. But when you fully understand what you’re investing in, and the risk level it represents, then you can make better investment decisions that cause you to prosper.

You can get a good start with understanding investments by subscribing to my YouTube Channel 🎉

Sow in good ground

When you invest money wisely, it multiplies exponentially over time. This produces more seeds that can be deployed for an even greater harvest in the future. Not all investments work out in your favor. But the better job you do at sowing your seed into good ground and tending to it well, your harvest will be much greater than your losses.

🚥 Avoid get-rich-quick schemes - be patient

Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty. – Proverbs 21:5

In this day and age, it is easy to get enticed with the promise of a quick buck. That’s why pyramid and Ponzi scams disguised as legitimate businesses are proliferating, preying on the greed and gullibility of people. After all, why wait 10 or 20 years to make millions of pesos when the same amount can be achieved in just a couple of months (or even weeks)!

The Bible has foreseen such dangers. Proverbs 28: 19-20 says: “Whoever works his land will have plenty of bread, but he who follows worthless pursuits will have plenty of poverty. A faithful man will abound with blessings, but whoever hastens to be rich will not go unpunished.”

Dishonest money dwindles away, but he who gathers money little by little makes it grow. (Prov. 13:11)

Avoid conflicting ideas between being patient and knowing when to exit. Don't become so emotional or attached to an investment that you ride it all the way down. Know when to exit. My best recommendation apart from clear exit signs are praying for discernment. I recently had an experience with this and talked about it in my YouTube video on investing as a PK.

⏳ Invest with urgency

Patience after you invest but the urgency to invest. I should manage seeds with a sense of urgency. This inclines me toward giving what I can now rather than saving up in order to give more later. Later may be too late.

Do you not say, “Four months more and then the harvest”? I tell you, open your eyes and look at the fields! They are ripe for harvest. Even now the reaper draws his wages, even now he harvests the crop for eternal life. (Jesus in John 4:35-36) As long as it is day, we must do the work of him who sent me. Night is coming, when no one can work. (Jesus in John 9:4)

I believe there is one verse that sums up godly investing principles really well:

“To those who use well what they are given, even more will be given, and they will have an abundance. But from those who do nothing, even what little they have will be taken away.” Matthew 25:29 NLT

We all tend to put things off. But by failing to save early, you forfeit one of the most potent financial forces: tax-free compound interest, or earning interest on interest.

Most people don’t postpone saving because they think saving is unimportant. Instead, they expect to have more disposable income down the road, or they have more pressing needs that get in the way, including debt payments, low wages, healthcare expenses, or the need to save for a child’s education. They plan to get to it later on.

But even if things do change down the road, money saved for retirement later has less time to grow (Matt. 25:27), meaning that you end up having to contribute much more to have the same amount if you started today.

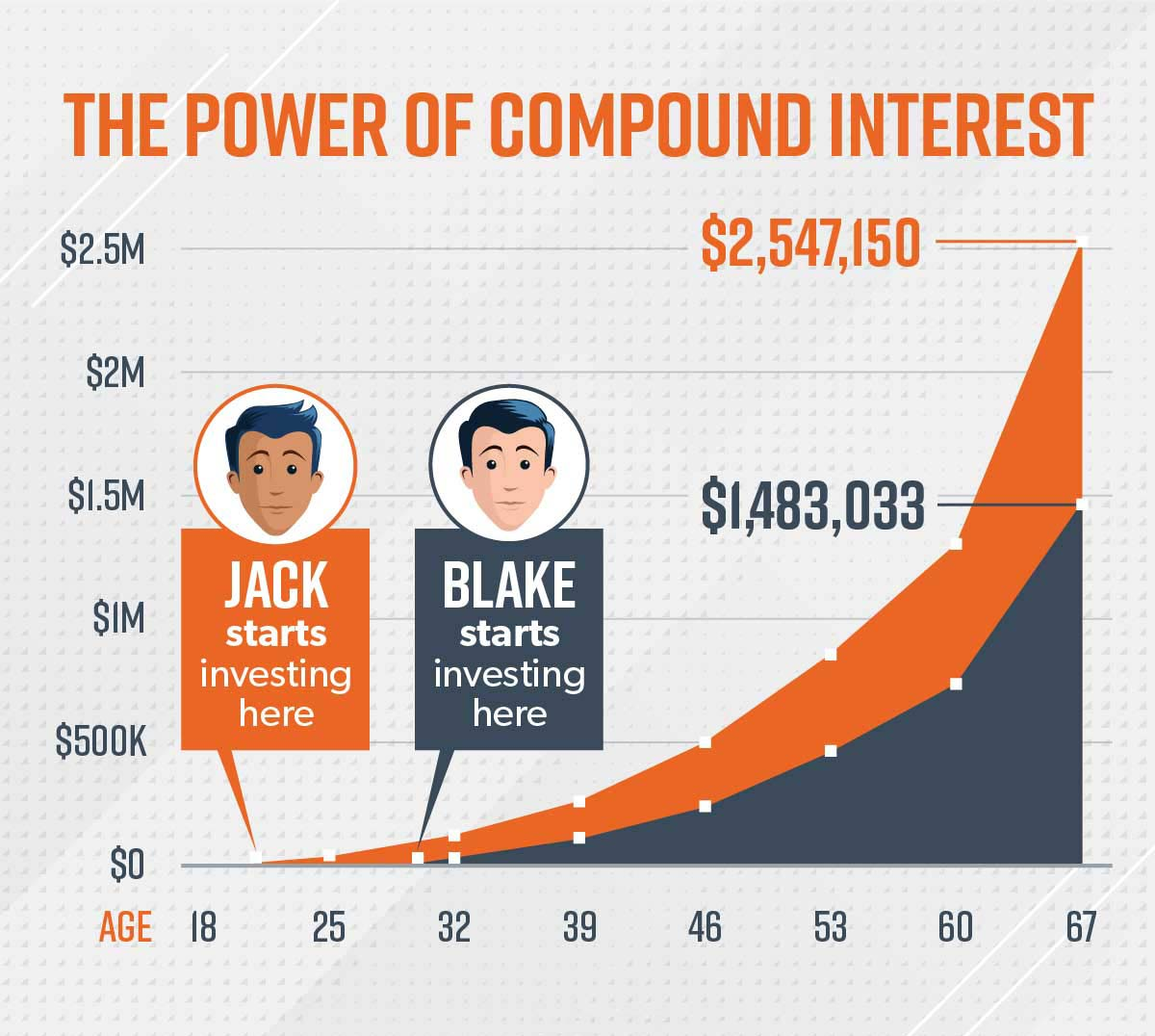

Just start by doing what you can and gain momentum over time. Take a look at this example below.

To help you see the power of compounding in action, here's the story of Jack and Blake—two guys who got serious about investing for retirement. They picked good, growth stock mutual funds that average an annual return of about 11.6%—just under the long-term growth rate of the S&P 500.

Jack

- Starts investing at age 21

- Invests $2,400 every year

- Stops contributing money at age 30

- Total amount contributed: $21,600

Blake

- Starts investing at age 30

- Invests $2,400 every year

- Contributes money until age 67 (a total of 37 years!)

- Total amount contributed: $91,200

At age 67, Jack’s investment has grown to $2,547,150, and Blake’s has grown to $1,483,033! Nine years made a difference of over one million dollars.

🙇 Seek Wise Counsel

“Whoever ignores instruction despises himself, but he who listens to reproof gains intelligence.” –Proverbs 15:32–

“Without counsel plans fail, but with many advisers they succeed.” –Proverbs 15:22–

Poverty and disgrace come to him who ignores instruction, but whoever heeds reproof is honored.” –Proverbs 3:18–

You can’t be a successful investor by going it alone. You need the help and advice of others if you want to truly succeed. Whether you seek out a qualified, licensed investment advisor, or you read a lot of books on investing, seeking wise counsel always pays off.

The best way to know someone’s ability to give wise investing advice is to look at their life. What is their success level when it comes to investing? Taking investment advice from a multi-millionaire investor is probably a good idea. Getting hot stock tips from Uncle Joe who has a mountain of debt and lives paycheck to paycheck is not.

The bible is the ultimate source of truth for all topics. Most people don't link financial advice to scripture but it includes money over 2000 times. When you seek wisdom from above and use the resources God has given us, only then can we truly built wealth and invest with our heart in the right place.